Cadence ($CDNS), Increasing. (No Paywall).

Summary

- We initiate coverage of Cadence at Hold rating.

- As big a run as the stock has had, we think it can continue.

- Read on!

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It Only Looks Like An Enterprise Software Business

by Alex King

Generally speaking I never worry about “the one that got away”. You can’t own every security that goes up; you have to make your choices, allocate your capital, rotate in and out of positions, compound your gains, rinse and repeat. If you follow our work here at Cestrian you know that’s our method. Find stocks and ETFs under institutional accumulation; do likewise. Wait as they run up through the Markup Zone. Then distribute when bigs are doing the same. Keep doing that whilst remaining dead inside and your account should be doing just fine over as a long a period as you can stay focused. Want to add some nitro to the mix? Try our long/short 3x ETF strategy. And if you’re doing all or any of this with even reasonable accuracy, then the occasional runaway success like $SMCI - which I confess I missed entirely - so be it. Can’t own ‘em all.

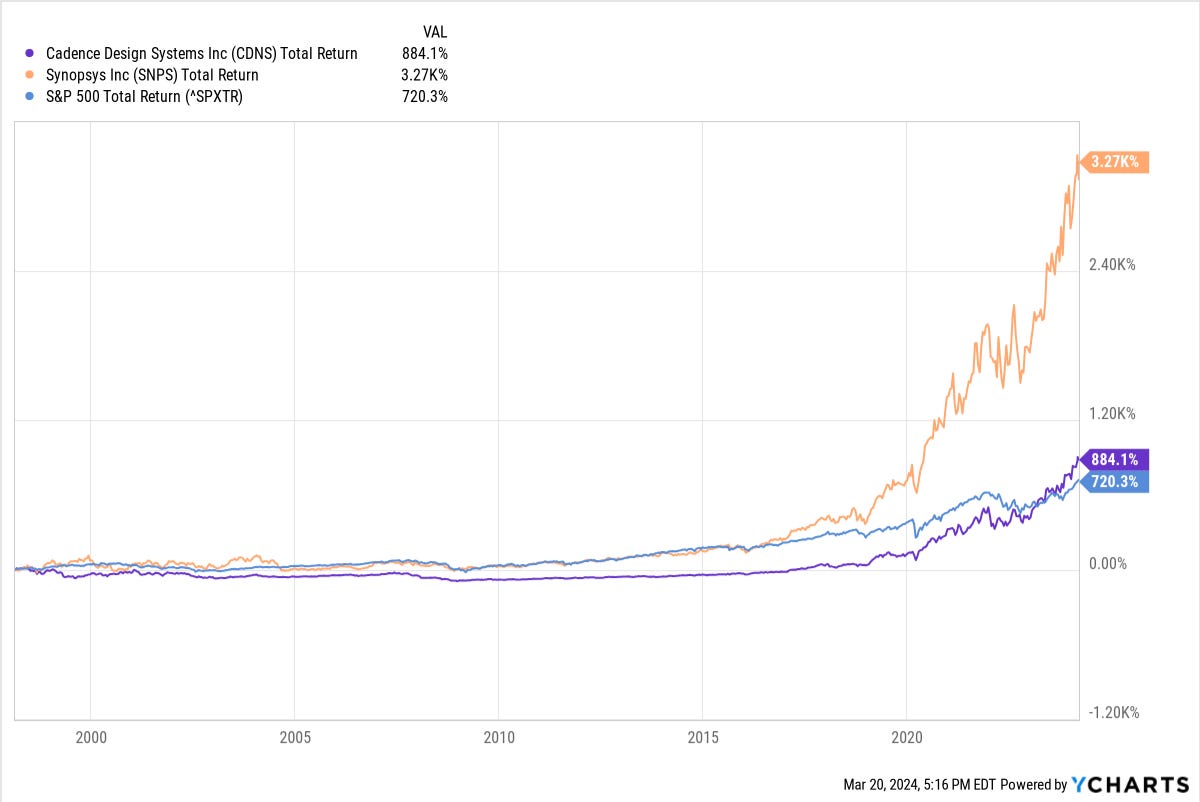

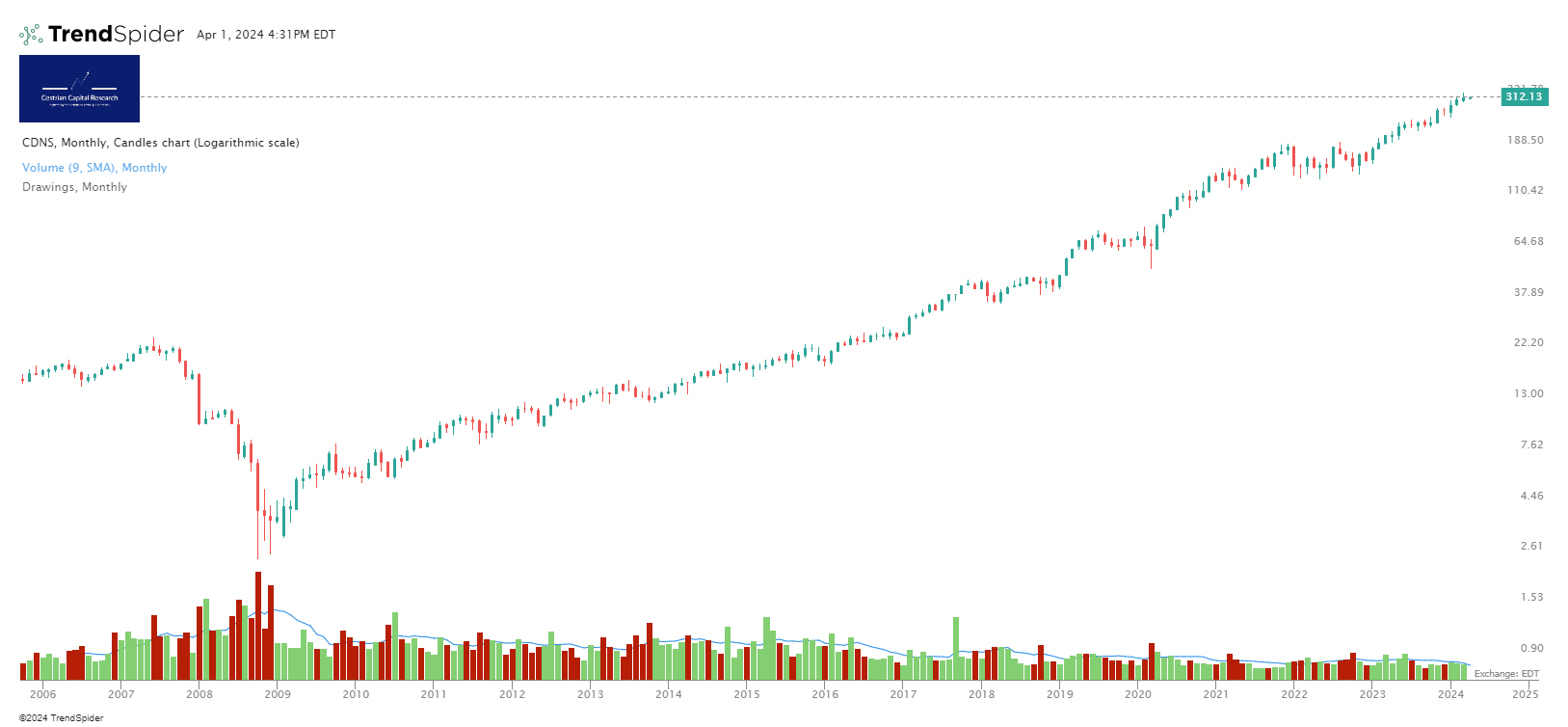

Two stocks that irk me, however, are Cadence Design Systems ($CDNS) and Synopsys ($SNPS). They irk me because I have known the companies for nearly 25 years but failed to either (1) own them or indeed (2) cover them in our various research services. Which is annoying, because this:

For some months now I have watched the two stocks - CDNS and SNPS - and seen an unstoppable bull move in each case. Though we haven’t covered the names, the bull move in semiconductor has delivered plentiful gains for me personally and anyone following the ideas in this service if you owned SOXL and/or AMD and/or NVDA and/or TQQQ and/or INTC etc.

The question for me has been, why these two EDA - electronic design automation, which is semiconductor for CAD, computer aided design - names have mooned to this degree. And this week a big ole lightbulb lit up and the A-HA moment arrived. Want to know how I know it was an A-HA moment? Because it made sense in a heartbeat; because it explains why SNPS launched years before CDNS (see the chart above); and because it chimes with my permanent rabbithole-inhabitant theory of, institutions know plenty before the news, and the chart will tell you what is happening months, years before the news as a result.

And the answer is, they aren’t EDA companies. Well, they are, at the moment, but soon they will be semiconductor intellectual property (IP) companies. What’s the difference? EDA tools are software applications used by engineers to design chips, or parts of chips. Chip companies buy licenses and/or subscriptions from EDA software companies, usual software economics apply. Semiconductor IP is a circuit layout that can form part or all of a chip. Chip companies license the IP from IP vendors and pay a royalty whenever they ship devices which includes that IP. Guess which is worth more? That’s right. The latter. Want evidence of semiconductor IP being a valuable thing? Check how $ARM, the world’s largest semiconductor IP business, is doing.

Synopsys was, in the 1990s and early 2000s, the no.2 player in EDA, Cadence was no.1. For a while there were a couple other vendors in the mix - Magma Design Automation was a distant third for a while - and Ansys ($ANSS) has been a big deal in the sector too, until it was sold to SNPS recently. But if you look at the chart above you can see that all of a sudden, SNPS fair leapfrogged CDNS’ stock performance. It started around 2018/19. Want to know why? Two reasons.

- One, SNPS made the move to subscription first, whilst CDNS stuck with perpetual licensing longer. Moving from perpetual to subscription is painful, expensive and short-term damaging to your stock - remember we called this play well with $SPLK prior to its sale to $CSCO - but if you take the hit before your competitors, you’re well placed longer term.

- And two - and this is key - SNPS started building a portfolio of semiconductor IP earlier and with more gusto than did CDNS. Now, if we ran a sellside shop here, we would have three 3rd year analysts prepping a deck to show how the EV/UFCF multiples for semi IP businesses eclipse those for enterprise software companies. But we aren’t, so, no 40-page deck, but, take my word for it, in fact, no, don’t, just look to that stock chart as logic. Synopsys owned USB 2.0 i/o intellectual property early on. They acquired MIPS, a key semi IP player, in 2013, which brought with it a unit of MIPS called ChipIdea, which developed analog semiconductor IP. We’ll get to analog semi companies in due course but for now we can just say - analog is hard, very hard, and analog IP is off-the-chart hard.

But what was it that market bigs knew over the last year that Chad didn’t? About these two companies specifically? I believe they knew that Nvidia was moving from being a fabless semiconductor business that made gadgets useful in various pursuits such as datacenter compute, vehicle automation, crypto mining, that kind of thing, and was becoming a quasi-monopoly supplier in AI silicon, software and services. If you missed it, watch the Nvidia event from this week. You can find it here.

That NVDA is moving to be a platform player - to mangle some definitions for a moment in the quest for simplicity, you can think of tomorrow’s NVDA as providing the horizontal operating system, systems and silicon enabling vertical market companies to provide AI capabilities into their own end-industries - means that CDNS and SNPS can do less and less EDA and more and more IP. And that means that all other things being equal, a dollar of cashflow at CDNS and SNPS is worth more tomorrow than it was yesterday. And that in my humble opinion is why these two names have been on a ripsnorting bull run of late.

I wish I was smart enough to have had the a-ha moment myself. But I didn’t. Credit is due to Chaim Siegel, a former pro hedge fund analyst, who now runs his own money and publishes some of his research. Guy is no slouch and no pretender. He previously worked for the storied Steve Cohen amongst others. You can check out his work here. I’ve been a paying subscriber to his service for years. I was sat in Chaim’s chatroom this week during Nvidia GTC when he mentioned that the platform play for NVDA meant that CDNS, SNPS could move up the value chain. And that, coupled with a bunch of other stuff I have been doodling with, led to me going, A-HA! And now I understand.

So, we start coverage of CDNS today, rating, Hold. If you have a long-term outlook and you’re not expecting to make banzai gains tomorrow, you could reasonably consider buying CDNS stock at these levels. It’s not at a major low, and it’s not in the classic rangebound-trending-sideways-at-the-lows pattern characteristic of institutional accumulation, so we’re not going to rate it at Accumulate. Bigs beat us to it for once. Shame. But whilst we are late money this time, I don’t think we are too late. So whilst I won’t be pouring a big allocation into this name, I shall be opening a position at the New York open tomorrow.

Fundamentals, valuation and technicals follow below.

We are upgrading our service to provide More Coverage, Deeper Analysis for Same Money. Subscribe to our one newsletter service, Cestrian Market Insight which will include a daily market analysis note, Continuous coverage of around 80-90 single-name stocks and ETFs, Extensive investor education material and Macro commentary and insight. If you’d like to sign up for the new Cestrian Market Insight newsletter - you can do so by clicking the button below. Just choose the “Market Insight” option.

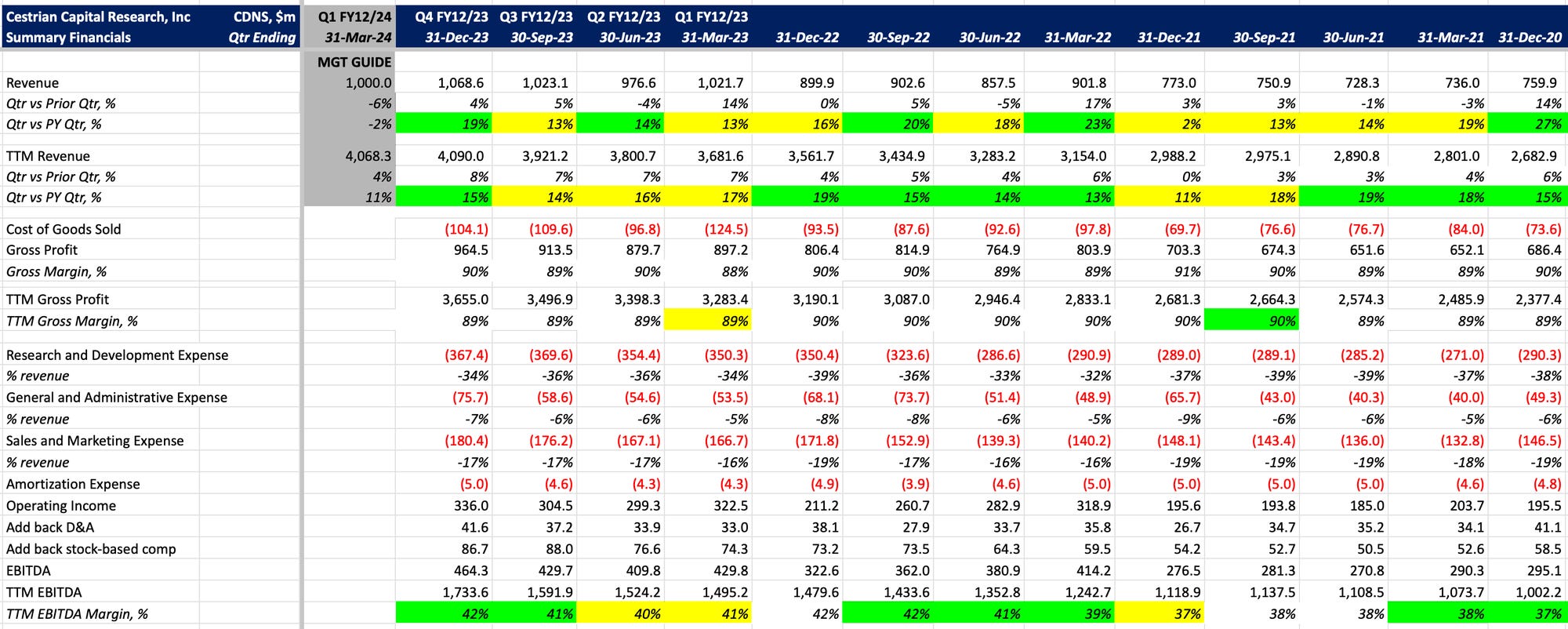

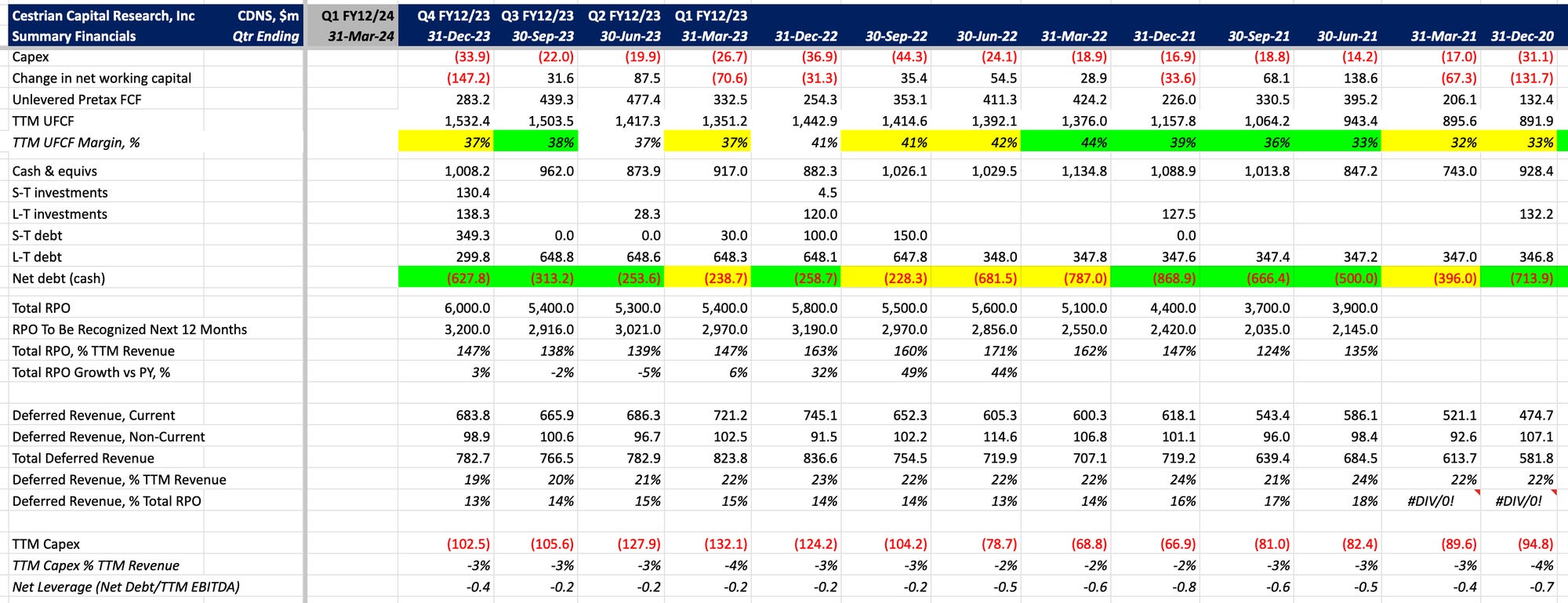

Fundamental Analysis

I'll get into the weeds on this on a later date, but in short, it’s an OK software business, not great. Growth vs. cashflow margin balance is fine. Deferred revenue balance is lower than you might expect. RPO performance isn’t as snowball-like as you would expect either.

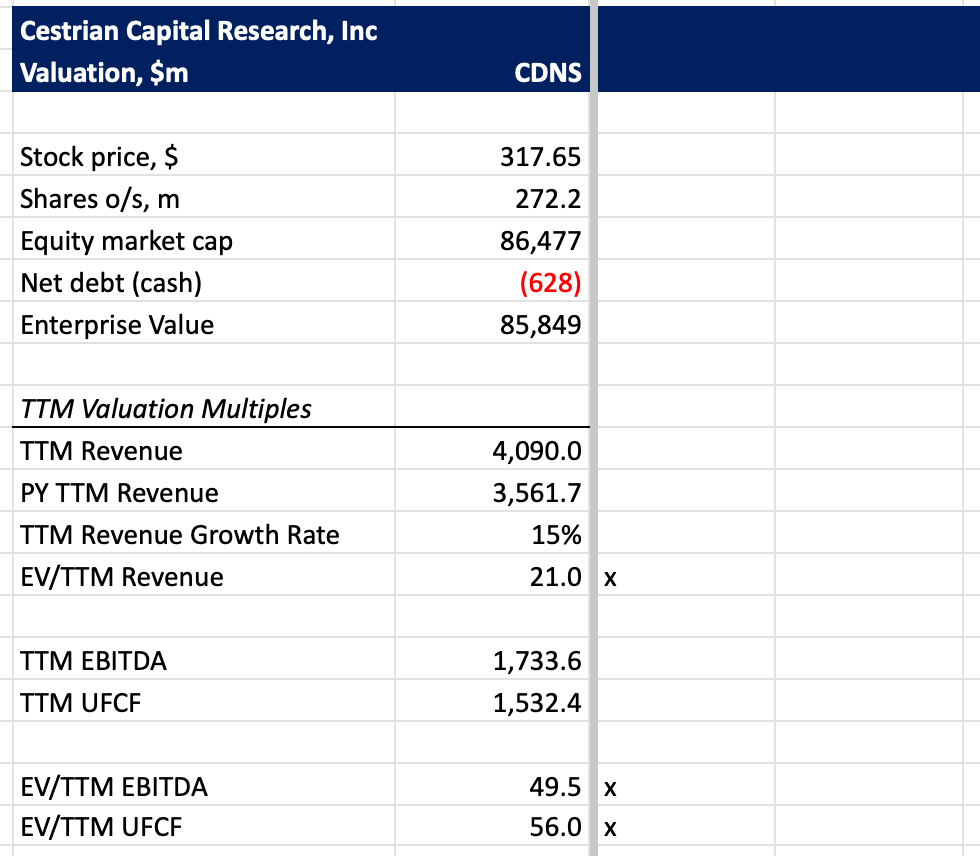

Valuation Analysis

The stock is pricey but not silly on fundamental multiples. Not a reason in and of itself to buy or sell in my view.

Medium Term Stock Chart

This is the technical pattern known as only-up; since the financial crisis lows in 2009. You can open a full page version of this chart, here. Log scale as you can see. Even scarier on a linear scale!

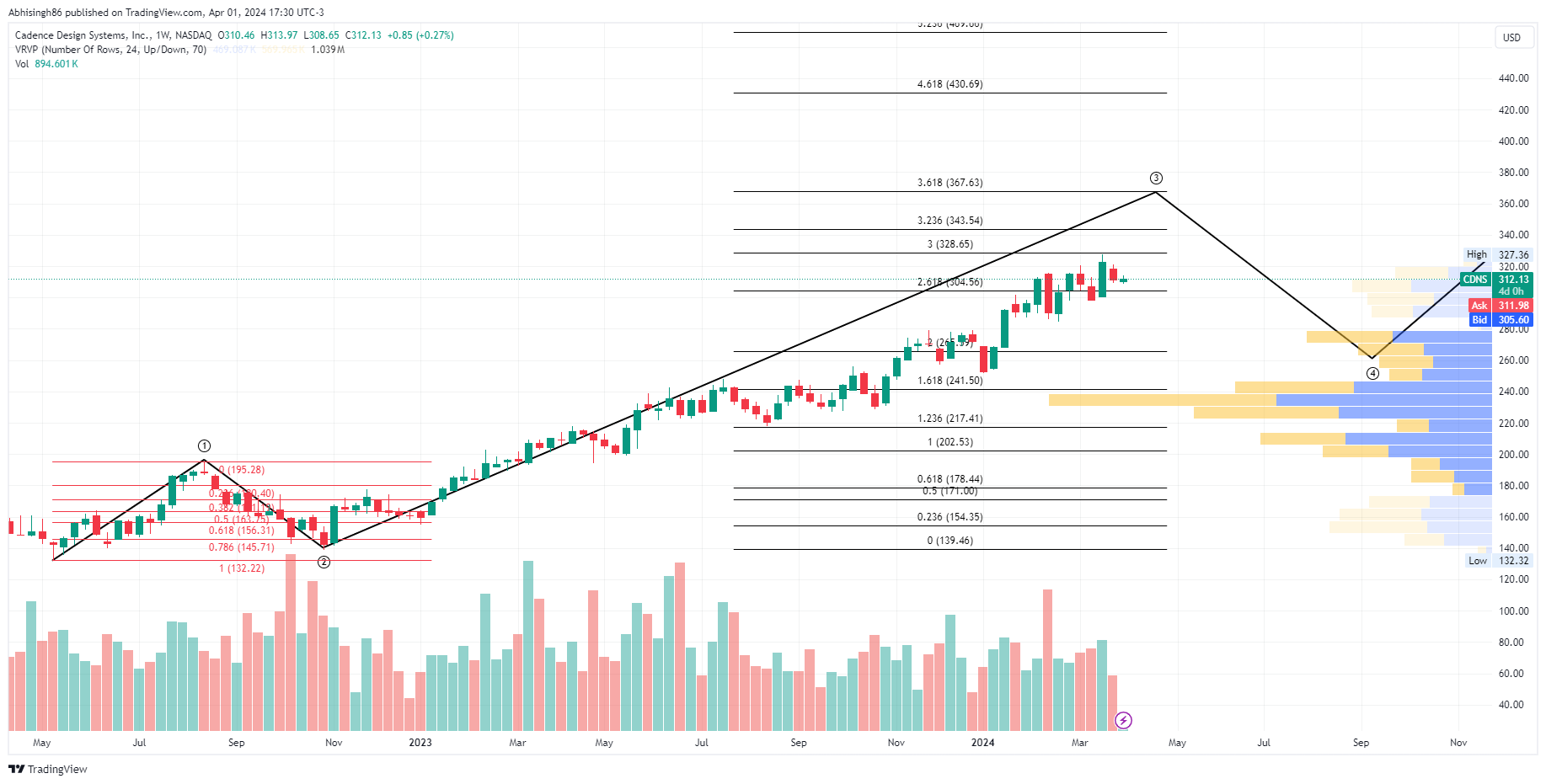

Short Term Stock Chart

If I had to guess, I would say CDNS can hit that 3.618 Wave 3 extension ($367 / share) without too much stress. You can open a full page version of this chart, here.

Rating

We open coverage at Hold.

Cestrian Capital Research, Inc - 02 April 2024.